Buying an RV is an unforgettable experience! Finding the perfect camper feels amazing, especially if it costs less than you thought it would.

But when it comes time to pay for your new camper, things can start getting stressful. You want to be 100% sure you’re getting the best deal and your family’s finances will be stable in the long run.

Bish’s RV has been helping RV buyers navigate the financing process for more than 30 years. Long story short: we know financing. We’d love to be able to help you find a great financing deal so you can start camping with your family — even if it turns out the best deal is not with us.

In this article, we’ll explore finding the best financing rates for your RV purchase. We’ll also look at the good and not-so-good things about financing an RV and where you can get an RV loan.

By the end of this article, you’ll know the ins and outs of RV financing, so when you’re ready to buy a new camper, you can make the best choice for your financial future.

Table of Contents

Josh The RV Nerd shares insights on Getting the Best Deal with Financing and Down Payments

What is RV Financing & How Does It Work?

RV financing is when you get a loan to buy a camper. Instead of paying for their camper all at once, many people choose to finance it. This means they borrow money to buy their RV and then pay it back over time, usually in monthly payments.

Getting RV financing is similar to getting a loan for a car. A lender gives you the money, and then you agree to pay it back with interest and fees. The loan terms can differ depending on things like your credit history, how much money you need, the interest rate, and how long you have to pay it back.

Different banks, credit unions, and online lenders offer RV financing. They look at your credit history and income to decide if they’ll give you a loan and what the terms will be. Sometimes you have to pay a certain amount upfront, and the lender can take away the RV if you don’t make your payments.

Before you decide to get RV financing, you need to understand the loan terms, interest rates, when you have to pay it back, and any extra fees. It’s a good idea to compare offers from different lenders to find the best deal.

It’s important to remember that the dealership usually receives a commission or fee for arranging the financing, which could affect the overall cost of your RV.

Got Financing Questions? Talk to one of our Financing Experts. Click the link below and scroll down to your nearest Bish’s RV location.

Financing and the Role of RV Dealerships

When you’re ready to purchase an RV, you usually have two options for financing: you can either get a loan directly from a financing lender or choose to finance through the RV dealership itself.

If you decide to go with financing through the RV dealership, the dealership acts as a middleman between you and the lender. They will help you with the loan process and handle all the paperwork.

Most RV dealers have partnerships with multiple lenders, which can make the financing process a lot more convenient. At Bish’s RV, each of our dealerships work with over 50 different lenders so it is very likely we can find the best financing deal available when you buy an RV with us.

RV dealers are very familiar with the terms and conditions of all the lenders they work with. They can usually find a fantastic loan for you based on your down payment, credit history and size of your loan.

Financing an RV Gives You Negotiating Power

Financing an RV loan can give you negotiating power when buying an RV because RV dealerships often consider the potential profits they can make when you finance through them.

When you secure a loan through the dealership, they earn money from the interest and fees associated with the financing. Knowing this can work in your favor during price negotiations.

Since dealerships anticipate making money from the financing deal, they may be more willing to negotiate a lower price for the RV itself. Dealers understand that by reducing the price, you will be more likely to buy the camper. They know they will still get the amount of money they cut from the price of your RV from the money they make through your financing loan.

This provides you with an opportunity to leverage your financing commitment and potentially secure a better deal on the overall cost of the RV.

If you decide to use available financing options, it shows RV dealers that you’re a serious buyer and they can make more money through financing. This can help you negotiate a better price when buying an RV.

Finding Your Own RV Loan

On the other hand, if you choose to get a loan directly from a bank or other financing lender, you’re cutting out the middleman. You’ll work directly with the lender to secure the loan and handle the necessary paperwork. This can give you more flexibility in terms of finding the best loan terms and interest rates.

Researching RV loans on your own can take a considerable amount of time. You’ll need to gather information, compare different lenders, and understand each loan option’s terms and conditions. This involves reading and analyzing loan terms, interest rates, repayment periods, and additional fees or requirements.

It can be a detailed process that requires careful attention to ensure you make an informed decision.

Remember, taking the time to research and understand your options can help you find the best RV loan that suits your needs and allows you to enjoy your adventures on the road.

Which is Better? Dealer Financing vs. Independent Financing

Both choices have advantages and disadvantages. Financing through the RV dealership can be easier because they take care of the financing process. However, you need to be sure you understand conditions of the loan and any extra fees associated with the financing, as this will affect how much you end up paying for your RV.

Choosing a loan from a financing lender directly gives you more power and possibly better loan choices, but you have to put in more time and work to research and compare different lenders.

RV Dealer Financing PROS and CONS

RV Dealer Financing PROS

- Convenience: The dealership handles the entire financing process, making it easier and more convenient.

- No need to find a lender: You don’t have to search for a lender on your own as the dealership takes care of it.

- Smooth paperwork process: The dealership handles all the necessary paperwork, saving you time and effort.

- Special financing offers: Dealerships may have partnerships with specific lenders, which can result in unique financing options or deals.

- Potential time and effort savings: Working with the dealership may save you time and effort in finding the best loan option for your RV purchase.

RV Dealer Financing CONS

- Limited options: When financing through a dealership, you may be limited to the lenders they work with, which means you might miss out on other potential loan options with better terms or rates.

- Potential for higher costs: Dealerships may charge additional fees or mark up interest rates on the financing to make a profit, potentially leading to higher overall costs for your RV purchase.

- Less control over the process: By relying on the dealership for financing, you have less control over the loan terms and conditions. You may not have as much flexibility to negotiate or tailor the loan to your specific needs.

- Need for careful review: It’s crucial to carefully review all the terms, conditions, and additional fees associated with the financing offer from the dealership. Some details might not be as favorable as they initially seem.

- Pressure to complete the sale: Dealerships may prioritize closing the sale and securing the financing, which could create pressure to make a quick decision without sufficient time for research or consideration.

Independent Financing PROS and CONS

Independent Financing PROS

- More options: You have the freedom to explore and choose from a wide range of lenders, giving you more chances to find the best loan terms and interest rates.

- Potential for better deals: By researching and comparing different lenders, you may find better financing offers that suit your financial needs and budget.

- Increased control: Finding your own financing puts you in charge of the loan process, allowing you to negotiate terms and conditions that work best for you.

- Possible cost savings: Independent financing can sometimes result in lower overall costs, as you can find lenders with competitive rates and fewer additional fees.

Independent Financing CONS

- Requires more effort: Searching for your own RV financing involves extra time and effort to research and compare lenders, review loan terms, and handle the necessary paperwork.

- Complex process: Understanding the various loan options and terms can be challenging, especially if you’re unfamiliar with financial terminology.

- Potential for confusion: Without professional guidance, there’s a possibility of feeling overwhelmed or confused by the different loan offers and requirements.

- Possibility of limited assistance: When finding your own financing, you won’t have the same level of guidance and support from the dealership, so you might need to rely on your own knowledge and resources.

- Miss out on Special Offers: A lot of RV dealers have special financing deals with lenders that you can only take advantage of by financing through the dealership and not through the lender directly.

6 Tips for Securing the Best RV Loan

To make sure you get the best financing deal for your RV purchase, here are some helpful tips:

- Do your research: Take time to look at different lenders and compare things like interest rates, loan terms, and conditions. Don’t just stick to regular banks; check out specialized lenders and online options too, as they might have good deals.

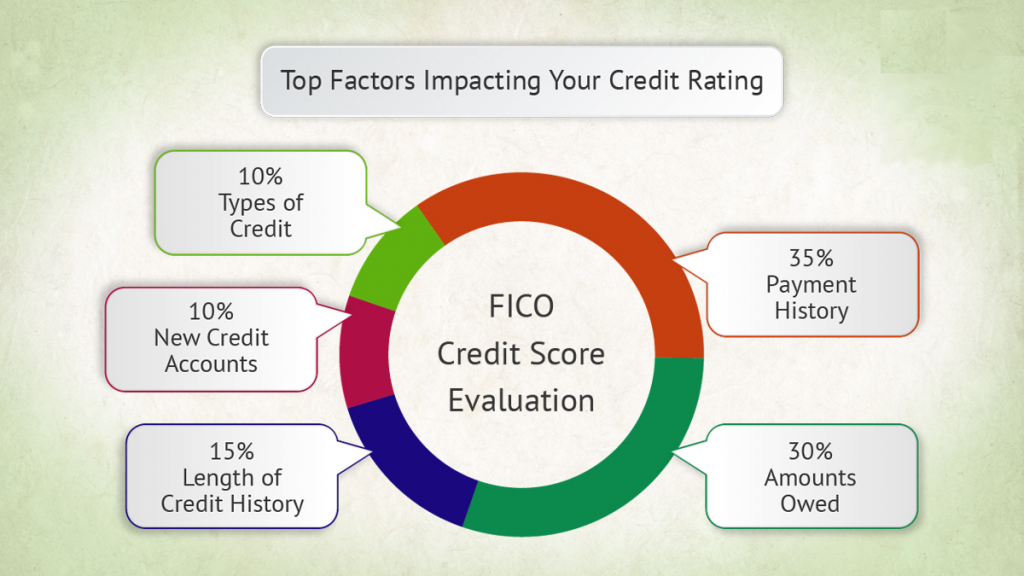

- Check your credit score: Before applying for a loan, determine your credit score. If any issues could affect your eligibility or interest rates, try to fix them. A good credit score shows that you handle money responsibly and can help you get better loan terms.

- Negotiate the loan terms: Don’t be afraid to talk to the dealership or lender about the loan terms and fees. You have the power to ask for better terms. You can try to get a lower interest rate, reduced fees, or even a longer time to pay back the loan if it suits your financial goals.

- Think about the total cost: While looking at loan terms and interest rates, remember to consider all the other costs of owning an RV. This includes things like insurance, maintenance, and other expenses. You want to ensure you can afford everything in the long run, not just the loan.

- Maintain stable employment and income: Lenders prefer borrowers with a steady source of income. Demonstrating a stable employment history and sufficient income can help you qualify for better interest rates.

- Refinancing: If you already have an RV loan, consider refinancing. Interest rates may have changed since you got the original loan, so refinancing could help you get a better deal. Look at the current market conditions and talk to lenders to see if refinancing is a good option for you.

3 Important Factors to Consider When Financing an RV

Think about these 3 important points when financing your RV:

- Down Payments: Look at how down payments affect your loan terms and interest rates. Most lenders want at least a 10% down payment to show you’re serious about buying.

Putting down a larger amount can lead to better loan terms, like lower interest rates and smaller monthly payments. Consider your money situation and see if a bigger down payment is possible. - Fixed-Rate vs. Variable-Rate Loans: Consider the advantages of fixed-rate versus variable-rate loans. Fixed-rate loans give you the same monthly payments for the whole loan period, which is more stable. Variable-rate loans might have lower interest rates initially, but they can change based on the market. Consider what you want for your finances, how much risk you’re okay with, and if you’re comfortable with possible changes in your monthly payments.

- Loan Repayment Options: Look at the long-term effects of different loan repayment options. Shorter loan terms mean higher monthly payments, but you can pay off the loan quicker and maybe save on interest. Longer loan terms give you smaller monthly payments, but you might pay more interest over the whole loan. Think about your financial abilities and what’s important to you so you can decide which repayment option matches your goals.

Calculate Your Monthly Payments when you Finance with Bish’s RV.

Getting the Best RV Financing Deal

Understanding how financing works can help you make smart choices. By being careful and informed, you can enjoy your RV adventures knowing you made good financial decisions.

Bish’s RV has helped thousands of RV buyers navigate the process of financing RVs. We are always ready to answer any questions you may have. Nothing makes us happier than being able to help families find the perfect RV to explore the outdoors.

Now that you know how financing an RV works, you’re ready to get back to the fun part— choosing which RV you want to explore the outdoors in!

If you are ready to start shopping for a Camper, check out these great deals on RVs:

If you have questions about financing or purchasing an RV, talk to one of our expert RV Outfitters!

Fill out this quick and easy financing form to know what kind of Financing deals you qualify for and figure out your budget!

Want to see what Monthly Payments look like when you finance an RV? Check out this FREE Payment Calculator.

Not quite sure if now is the best time to buy an RV? You can learn more about the Cost of RVs at Our Bish’s RV Learning Hub.

Josh the RV Nerd has more information on What to Avoid when Financing

Greg Long

Bish’s RV Content Manager

Amateur adventurer; professional dreamer.

aka: The Bish-Blog-Guy