Owning an RV is an exciting way to combine the comforts of home with the freedom to travel. Beyond the excitement and adventures, many people are asking: “Can owning an RV save me money on taxes?” The short answer: yes!

At Bish’s, we love nothing more than helping you save money, even if it’s long after you’ve purchased an RV. We break down the ins and outs of the key tax benefits of RV ownership!

Table of Contents

Second Home

Business

Rental

Depreciation

State Specific

**This article is not meant to serve as official tax advice. Always check with a certified tax professional for what is applicable to you.

How to Qualify Your RV as a Second Home for Tax Deductions

Can I write off my RV as a second home? Yes, your RV may qualify as a second home!

The RV must have sleeping, cooking, and bathroom facilities to qualify for tax deductions under the second home rule. Once qualified, you can deduct mortgage interest and even property taxes.

- Pro: Just like with a traditional second home, you can deduct interest on loans used to purchase the RV, potentially reducing your taxable income. This can lead to significant savings, especially in the early years of your loan when interest payments are highest.

- Con: Your RV must meet specific IRS guidelines and only interest on up to two homes can be deducted. This means if you already have a primary residence and a vacation home, your RV may not qualify for this deduction.

Example: Suppose you purchased an RV for $100,000 with a 10-year loan at 5% interest. In the first year, you could potentially deduct up to $5,000 in interest payments, which could result in substantial tax savings.

RV Business Use Tax Deductions: How to Write Off Expenses

Are there tax deductions for using my RV as a business? Yes, if you use your RV for business purposes!

If you run a business or use your RV as a mobile office, you can claim certain expenses related to its use. Maintenance, depreciation, and even part of the purchase price (via Section 179) may be deductible.

- Pro: Deducting a portion of expenses like fuel, repairs, and insurance can significantly lower the cost of running your business. This can be particularly beneficial for digital nomads, traveling consultants, or mobile entrepreneurs.

- Con: The RV must be used primarily for business, and detailed records of mileage and use must be kept to satisfy IRS requirements. This means you’ll need to be diligent about tracking your business versus personal use.

Example: If you’re a travel blogger who uses your RV 70% for business and 30% for personal use, you could potentially deduct 70% of your RV-related expenses. This might include 70% of your fuel costs, maintenance expenses, and depreciation.

RV Rental Income: Tax Strategies and Deductions You Need to Know

Can I deduct RV rental income? Yes, rental income is taxable, but you can also deduct related expenses!

There are RV rental income tax strategies for owners. If you rent out your RV for part of the year, the IRS allows you to deduct expenses related to the rental, including maintenance, insurance, and repairs, as long as they align with the percentage of rental use.

- Pro: Income generated by renting your RV can help offset your expenses, while deductions reduce the tax burden. This can turn your RV into a revenue-generating asset during times when you’re not using it.

- Con: You’ll need to navigate the complex tax reporting process for mixed-use properties, and keeping detailed records is critical. You’ll also need to report all rental income, even if it’s just for a few weekends a year.

Example: If you rent out your RV for 100 days a year and use it personally for 50 days, you could deduct about 66% (100 / 150) of your annual expenses related to the RV. This might include insurance, maintenance, and even storage fees when it’s not in use.

No Hidden Fees

The Low Price IS the Price!

RV Depreciation: How to Deduct and Maximize Your Tax Savings

Can I deduct depreciation on my RV? Yes, if it’s used for business or rented out.

If your RV is used for business, you can depreciate the cost over several years, reducing taxable income. This can result in significant savings, especially in the earlier years of ownership.

- Pro: Depreciation can be a powerful tax-saving tool over time, especially when using your RV for rental or business.

- Con: Depreciation recapture may apply if you sell the RV at a gain, meaning the IRS may claw back some of the tax benefits.

Example: Let’s say you purchase a $100,000 RV for business use. Using the straight-line depreciation method over a 5-year period, you could potentially deduct $20,000 per year from your taxable income. However, remember that if you sell the RV for more than its depreciated value, you may owe taxes on that difference.

State-Specific Tax Benefits for RV Owners: What You Should Know

Are there state specific RV registration tax advantages? Yes, tax benefits vary by state.

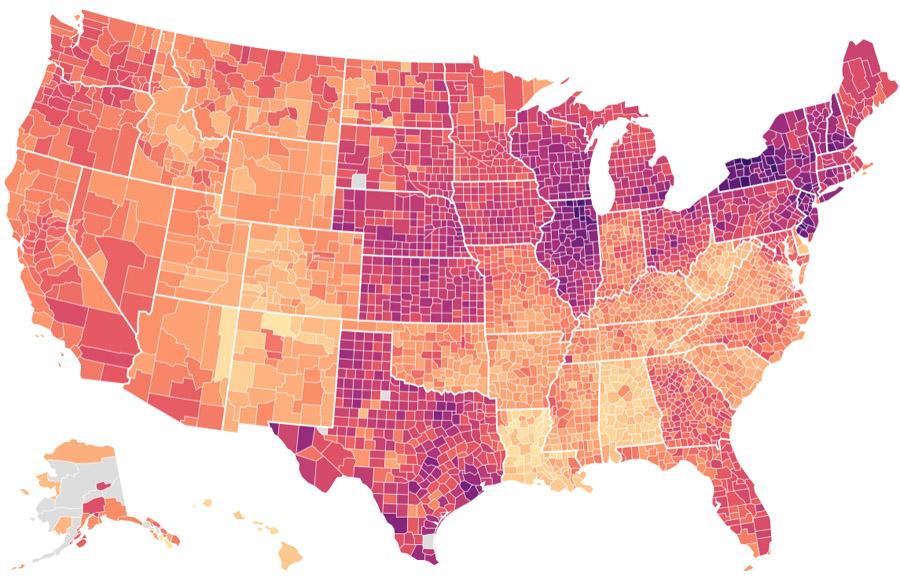

Some states offer additional tax advantages for RV owners, such as no sales tax or lower property taxes for RVs. It’s important to research state-specific laws, as you might be able to avoid hefty taxes depending on where you register your RV.

- Pro: States like Montana and South Dakota are famous for their RV-friendly tax structures, saving owners thousands of dollars.

- Con: Moving or registering your RV in another state requires following complex residency rules.

Pros and Cons of Owning an RV for Tax Purposes

Pros:

- Mortgage Interest Deduction: Your RV can qualify as a second home, allowing you to deduct mortgage interest.

- Business Deductions: If your RV is used for business, you can deduct operational expenses and depreciation.

- Rental Income: Renting out your RV can generate income while deductions reduce the associated tax burden.

- State Tax Benefits: Depending on where you register, you could save on sales and property taxes.

Cons:

- Strict IRS Guidelines: You must carefully follow IRS regulations to qualify for these deductions.

- Record Keeping: Detailed records are required to substantiate business or rental use deductions.

- Depreciation Recapture: Selling your RV after taking depreciation deductions can trigger recapture taxes.

- Limited to Two Homes: If you already have a second home, you may not be able to deduct RV mortgage interest.

Owning an RV can provide substantial tax benefits, whether it’s through mortgage interest deductions, business use, or state tax advantages.

But these perks come with rules and regulations, so it’s essential to understand how your RV fits into your overall financial plan.

Always consult a tax professional to ensure you maximize your deductions while staying compliant with IRS rules.

Brooke Erickson

Some say I am a writer…I like to say I am a storyteller.