Looking to buy an RV but wondering how your credit score will affect your chances of locking in low rates?

Curious about whether it’s better to finance your camper through the dealer or if you should try to find a loan on your own?

In this article, we’ll cover everything you need to know about paying for an RV—from understanding loan terms and why down payments matter to getting the best price and considering ongoing expenses you will have once you buy your camper.

After reading these 7 simple RV financing tips, you will be ready to find the best financing options for the camper of your dreams — and know all the tricks to make that dream a reality.

TABLE OF CONTENTS

Curious how to lock-in monthly payments you can afford?

Check out our Free Payment Calculator!

Why Finance an RV?

When it comes to investing your hard-earned cash, it’s important to make smart decisions that give you the most value for your money.

Campers cost a lot, but their value quickly depreciates, meaning they are worth less money as time passes. Here’s why financing an RV can be a wise money-move compared to paying with cash.

Preserve Cash Value

A camper loses value as soon as it leaves the dealership lot.

By financing your RV purchase, you can save the money in your bank account for investments that actually gain value over time, such as stocks, real estate, or retirement accounts.

This way, you can maintain and potentially grow your wealth while still enjoying the benefits of RV ownership.

Negotiating Power

Choosing to finance your RV provides you with negotiating power when purchasing your vehicle.

Dealerships are more inclined to offer competitive prices and favorable terms to customers who secure financing through them.

Flexible Payment Options

Financing an RV allows you to choose a payment plan that fits your budget and financial goals.

Rather than depleting your savings with a large upfront payment, you can spread the cost of your RV over time with manageable monthly installments. This allows you to maintain financial stability while still enjoying the benefits of RV ownership.

Build Credit History

Making regular payments on your RV loan is an excellent way to build a positive credit history.

Timely payments show your reliability as a borrower and can improve your credit score over time. A strong credit score opens doors to better financing opportunities in the future, such as lower interest rates on mortgages or car loans.

7 Tips to Get the Best RV Financing

Finding the perfect camper can be fun, but deciding how to pay for it can be stressful.

What will your monthly payments be? How much interest will you have to pay? How much of a down payment do you need?

It’s hard to know who to trust, especially when it feels like everyone’s trying to make money off you.

Here at Bish’s RV, we get it. That’s why we promise to be honest with you and share our insider knowledge so you can confidently find the best financing options for your camper.

These 7 tips will help you make smart choices and feel good about your decisions.

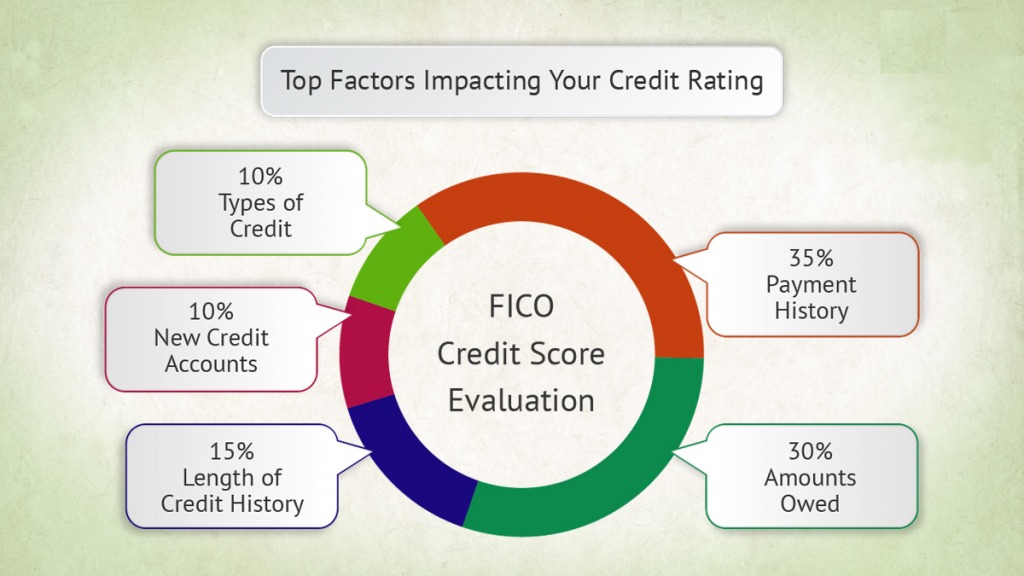

Tip #1: Understanding How Your Credit Score Affects RV Financing

Your credit score is the biggest factor determining how good a loan you will get.

While it’s no secret that a higher credit score typically means you will get lower interest rates, it’s important for you to understand that even individuals with lower credit scores can still secure financing for their dream RV.

RV dealerships partner with lenders who specialize in approving customers across a wide range of credit situations, making RV ownership possible for many hard-working families who thought they might not be approved for a loan.

It’s important to recognize that RV financing differs from financing a car, particularly concerning credit score and credit history.

Difference Between Car Loans and RV Loans

Unlike car loans, RV loans often require a higher credit score to qualify for the best financing terms. As a result, it’s not uncommon for RV loans to carry slightly higher interest rates than car loans.

Additionally, lenders may request proof of income to assess your ability to repay the loan.

While the possibility of higher interest rates or additional documentation may seem unfair, it’s all part of the process of securing financing for a big-ticket item like an RV.

Dealers like Bish’s RV understand credit reviews can be frustrating and are always happy to answer any questions you may have about how your credit score influences RV financing.

Our Finance Managers are always happy to answer your questions about buying an RV- no matter who you buy from.

Tip #2: The Best Place to Get an RV Loan

When it comes to getting the best financing for your RV purchase, you have several options to choose from.

National and local banks, credit unions, and even online lenders all offer RV lending programs. If you qualify, some of these loans have great rates, but you’re on your own when negotiating the minimum monthly payments, interest rates, and small print agreements.

One of the best resources for finding the right RV loan is often overlooked: the Finance Manager at the RV dealership.

Dealership Finance Managers work with dozens of major banks and local credit unions, allowing them to identify the best financing options for your purchase. They do all the work at no extra cost to you.

Because Finance Managers know a lot about finding loans, they can set up financing right at the dealership, making things easier for you. Plus, since dealerships work with so many lenders, Finance Managers can often get better deals than you could on your own.

Rather than spending time shopping around for an RV loan on your own, it pays to trust the dealership to find the best financing for you. Their ability to negotiate with multiple lenders often results in competitive interest rates and favorable loan terms.

By allowing the dealership to do the legwork, you can focus on selecting the perfect RV for your adventures, knowing that you’re securing the best possible financing solution.

Tip #3: Understanding the Terms of Your RV Loan

When it comes to RV loans, the terms can be quite different from those of car loans. You might be surprised to learn that RV loan terms can stretch as long as 180 months (15 years)—or even up to a whopping 240 months! (20 years)

But why are RV loan terms so lengthy?

RVs are a whole different ball game compared to cars. They’re used differently, and banks recognize this.

That’s why they’re often willing to offer longer loan terms for RV purchases. And here’s the kicker: unlike car loans, longer loan terms for RVs can actually work in your favor.

The longer the loan term, the lower the interest rate tends to be.

And when the interest rate is lower, your monthly payments become more affordable.

So, don’t be surprised if you see surprisingly low monthly payments for that dream RV you’ve been eyeing.

With longer loan terms and lower interest rates, financing your RV can be a smart and affordable option, allowing you to spread out your payments over time without breaking the bank.

Tip #4: It Pays to Make a Down Payment

When you’re buying an RV, putting money down upfront can make a big difference and help you get some great deals.

Banks and lenders like to see that you’re committed to the purchase, and nothing demonstrates your seriousness more than a healthy down payment.

Most lenders prefer to see at least 10% down from customers—a threshold that signals your investment in the purchase.

But here’s the real perk: making a 10% down payment can lead to lower interest rates on your RV loan.

Lenders are more inclined to offer favorable terms when they see that you’ve invested a substantial amount upfront. In fact, the more money you put down, the more your interest rate is likely to decrease.

So, while it may require some initial financial commitment, making a down payment on your RV can pay off in the long run. Not only does it demonstrate your dedication to the purchase, but it can also lead to lower monthly payments and overall savings throughout the life of your loan.

Tip #5 Trading in Your Used RV for Better Financing

Are you curious about how dealerships determine your RV’s value when you want to trade it for a new one? It’s actually quite straightforward.

Every few months, third-party appraisal services, update the “book-value” of used RVs.

To learn how to determine your used RV’s “book value”, read our article, How much does a Used RV Cost?

While there’s some complex math involved in determining this value, the reassuring part is that every dealership relies on the same information. So, if one dealership offers significantly less for your trade-in than another, it’s fair to question their motives.

However, it’s important to recognize that while your RV may hold sentimental value for you, to someone else, it’s simply a “used” RV. And unfortunately, used RVs generally aren’t as valuable as new ones. So, while you may cherish the memories made in your RV, its trade-in value is ultimately determined by market demand and the next owner’s perception of its worth.

Understanding this can help you manage your expectations when trading in your RV. While it may not be as valuable to the dealership as it is to you, trading it in can still provide you with valuable leverage when negotiating financing for your new RV.

When considering trading in your used RV, focus on the opportunities it presents to secure better financing terms rather than solely on its sentimental value.

Thinking of trading-in your RV and upgrading to a new one? Find out what your camper is worth!

Tip #6: How to Negotiate the Best RV Financing Deal

Ever heard the saying, “If it’s taxable, it’s negotiable”?

Let’s break it down. When you’re buying an RV and you see taxes added to the price, it means that part of the cost isn’t set by law.

So, what falls under taxable? Well, the RV itself, any dealer options, and even the Finance and Insurance products like service contracts or paint and fabric protection—all of these are up for negotiation.

Now, dealerships are in business to make money, but that doesn’t mean you can’t negotiate a better deal.

Don’t be afraid to haggle a bit and see if the price can come down.

Keep an eye out for extra fees that some dealerships tack on, like “prep fees” or “delivery fees.” While fees related to tax, title, licensing, or documentation are legit and regulated by the government, others might be inflated or unnecessary.

If you want more advice on how to avoid hidden fees at RV Dealerships, check out our Bish’s Learning Hub article.

By knowing what’s negotiable and being willing to push for a better deal, you can secure the most favorable financing terms for your RV purchase. So, don’t hesitate to advocate for yourself and ensure that you’re getting the best possible deal when it comes to financing your RV adventure.

Tip #7 Additional costs to consider when financing your RV

When budgeting for your RV purchase, you must account for additional costs beyond the sticker price.

Here are some key factors to consider:

RV Insurance: Before lenders approve financing, they typically require proof of insurance. However, not all RV insurance policies are created equal.

Many standard insurance packages may not provide adequate coverage for your RV’s unique needs. Instead, seek out specialized RV insurance coverage tailored to motorhomes, trailers, or campers.

Avoid opting for generic “bundle” packages and ensure your policy offers comprehensive protection for your investment.

Service Contracts and Surface Protection: Unlike cars, RVs are complex vehicles with intricate systems that require regular maintenance and upkeep. From plumbing and electrical systems to mechanical components, RVs undergo significant wear and tear over time.

To safeguard against costly repairs and damage, consider investing in service contracts and surface protection applications, such as “paint and fabric protection.”

These products can help extend the lifespan of your RV and lessen the burden of unexpected repairs. Most reputable dealerships, like Bish’s RV, offer these options, and it’s highly recommended to include them when financing your RV to protect both your vehicle and your wallet.

By factoring in these additional costs when financing your RV, you can ensure that you’re prepared for all the expenses of RV ownership.

Investing in comprehensive insurance coverage and maintenance protection is worth the extra expense and will usually save you money in the long run.

An RV will cost you more than just the purchase price. Find out The True Cost of RV Ownership by reading our article on the Bish’s Learning Hub.

Next Steps to Finance Your RV With Confidence

If you started this journey with questions about RV financing and securing the best deal, you’re now prepared to buy your camper with confidence.

Throughout this guide, we’ve provided tips and must-know information to help you make smart decisions about financing your RV purchase.

At Bish’s RV, we’ve been helping hard-working people like you with financing for years, and we’re always here to answer any questions you may have.

Follow these next steps to get the best financing for the camper of your dreams.

- Explore Our Inventory: Browse our extensive selection of RVs to find the perfect fit for your lifestyle and budget.

- Speak with Our Finance Experts: Reach out to our experienced finance team for personalized guidance and assistance in securing the best financing options for your RV purchase.

- Monthly Payment Calculator: Want to know what your monthly payments will be? Use our Free payment calculator and find out.

- Insider Secrets: Read our blog with RV Dealership tips and tricks for securing the best prices, rates, and payment schedules.

With Bish’s RV by your side, your RV adventure awaits. Start your journey today and make memories that will last a lifetime.

Read More

- The 2025 RV is Newer—So Why Is the 2024 Camper a Better Deal?

- 6 Nasty Surprises If You Don’t Get Your RV Ready for Spring

- Five RV Tech Upgrades to Improve Your Camping Trips

- Brinkley Model I 294 Review: Best Family Travel Trailer with Enclosed Bunkroom & Luxury Features

- How Much Does a Wayfinder RV Travel Trailer Cost?

Greg Long

Bish’s RV Content Manager

Amateur adventurer; professional dreamer.

aka: The Bish-Blog-Guy

Why Finance an RV?

Why Finance an RV?